Accounts Payable and Vendor Management

Control your costs with SoftLedger's accounts payable automation and approval workflows.

Accounts Receivable and Customer Invoicing

Collect quicker with recurring and usage-based accounts receivable automation.

General Ledger

Incredibly fast to implement and seamlessly adapting to your business - that's how SoftLedger's smart general ledger empowers your business.

Real-Time Financial Reporting

Enable agile and confident business decisions with SoftLedger's real-time software.

Cash Flow Management

Control your working capital with SoftLedger's cash flow management software and tools.

Digital Asset Accounting

Get a powerful crypto accounting software that automates all your cryptocurrency transactions.

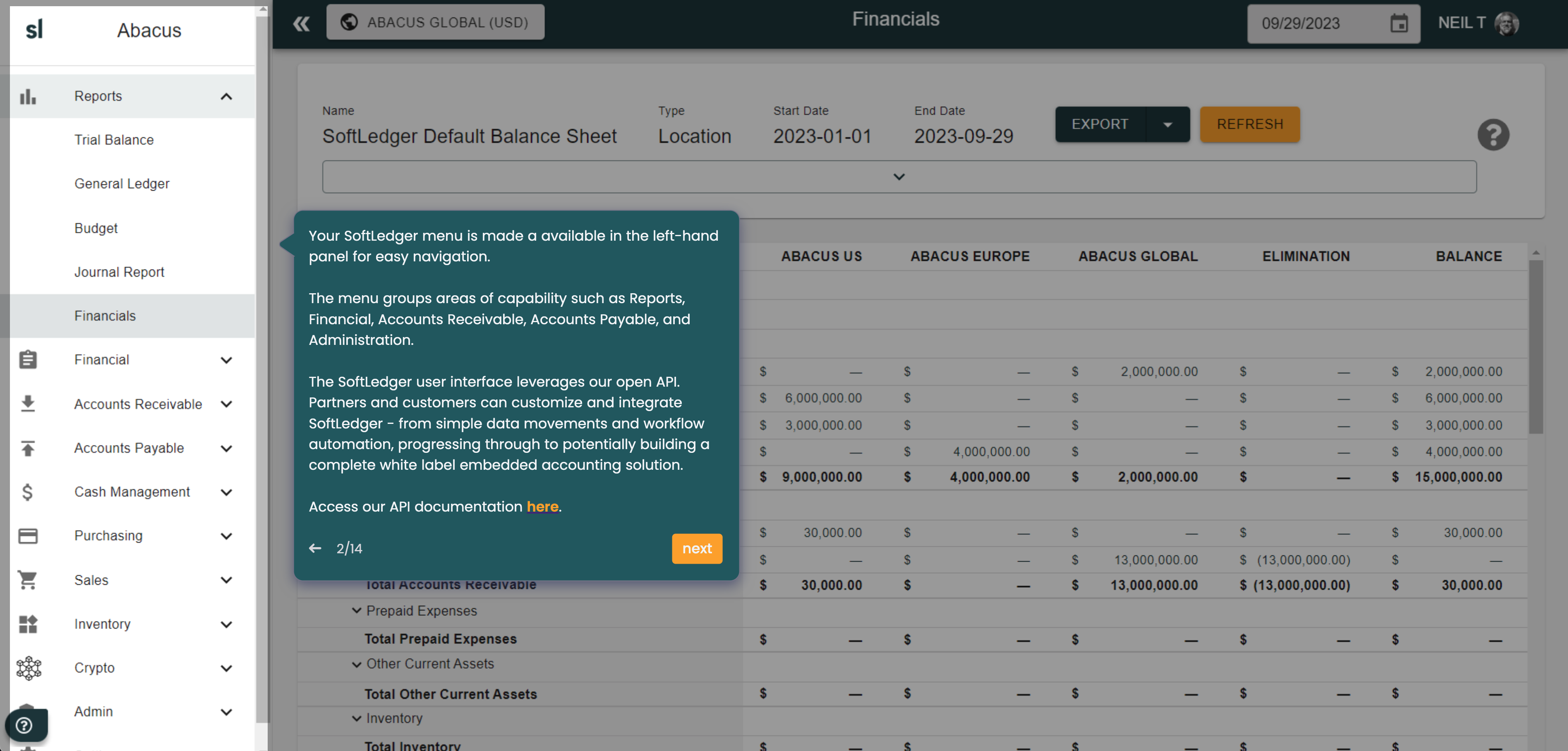

Accounting API

Get a cloud accounting software that is fully programmable via API.

Embedded Accounting

Win more, higher paying deals and increase customer retention with SoftLedger's embedded accounting solution.

Open Banking API Integration

SoftLedger is entirely programmable via the Open Banking API, enabling instant financial data consolidation.

Adaptable Subledger

Use only Accounts Receivable, Accounts Payable, or another module as your accounting subledger.

Consolidation Accounting

Instantly centralize your multi-entity, multi-currency accounting with SoftLedger's financial consolidation software.

Multiple Entity Accounting

Consolidate multiple businesses, properties and investments, in real-time.

Digital Assets Industry

The ideal tool for tracking your crypto asset management transactions in a scalable way.

Venture Capital

SoftLedger's venture capital accounting software is feature-rich to support all your consolidation needs.

Family Offices

SoftLedger makes it easy to consolidate reporting for family offices in one system.

Private Equity

Get greater visibility into your investment data and harness opportunities as they arise with SoftLedger's sophisticated features.

Financial Services

A full-featured financial services accounting software letting you easily handle multiple entities.

Real Estate Investors & Developers

Overcome complexity by seamlessly consolidating your financials across real estate investments and development projects.

CPA Firms & Accountants

Say goodbye to manually tracking login info and software versions! Find out how SoftLedger helps your accounting office make work easier.

Software Developers

Get our easy-to-use SaaS accounting software and significantly decrease your time spent on operations.

Healthcare

SoftLedger's flexibility enables quick and easy adaptation to the changing healthcare landscape.

SaaS Companies

Our API-capable accounting software makes your subscription management a cinch. Let us show you how.

Retail

Seamlessly track and integrate your inventory with SoftLedger's retail accounting software. Get a demo and see how.

Franchises

If your franchise accounting software isn’t specifically built to manage multiple entities, it could be holding you back from getting the information you need. That's where SoftLedger comes in.

Manufacturing

Easily track your costs and manage your inventory through every stage of production with SoftLedger's manufacturing accounting software.

Nonprofit Accounting

Easily aggregate transactions and activities across your organization with SoftLedger.

Church Accounting

A complete solution built to streamline your faith-based organizations' financial management and accounting processes.